4. What does a Home Care Package cost?

Page 4 of 21

What does a Home Care Package cost? There are costs associated with Government Funded Home Care Packages that are not charged with privately paid care, which consumers with a Home Care Package need to understand. Discover here the true costs of a Home Care Package. This is a really important page to understand especially for Part-Pensioners and fully Self-Funded seniors.

The cost of a Home Care Package depends on your Pensioner, Part-Pensioner or Fully Self-Funded status.

- Full Pensioners receive a Government Funded Home Care Package because they pay no Income Tested Care Fee, and from 1/7/2019 Daughterly Care waived the Basic Daily Care Fee. This means Pensioners who choose Daughterly Care to manage their Home Care Package receive a fully funded Home Care Package.

- Part-Pensioners pay no Basic Daily Care Fee with Daughterly Care from 1/7/2019, however the Government will ask you to pay part of the Income Tested Care Fee. That’s why we say you receive a Subsidised Home Care Package. Read the Income Tested Care Fee section further down this page for more information.

- Fully Self-Funded or Non-Disclosed Seniors pay no Basic Daily Care Fee with Daughterly Care from 1/7/2019. The Government requests you pay the Maximum Income Tested Care Fee, see below for more detail. Your Home Care Package is the least subsidised by the Government.

- If your Home Care Package started before 1/7/2014 then you pay no Income Tested Care Fee and if you choose Daughterly Care, you pay no Basic Daily Care Fee, so your Home Care Package is Government funded.

There are 3 types of costs payable for a Home Care Package:

- Costs set by the Government, paid from your pocket. This does not apply to pensioners;

- Costs set by the Approved Provider for Home Care Package Management and Care Management. These costs are paid by your Home Care Package, you don’t pay them from your pocket. From 1/1/2023 they cannot exceed the maximum cost set by the Department of Health;

- Costs for direct care or support services bought or provided by the Home Care Package via your Approved Provider or companies they contract to. These costs are deducted from your Home Care Package, so they are not paid from your own pocket. If you want more services than your Home Care Package can afford, you can pay privately for those costs.

This statement is true providing you do not want any additional care above what the Government funding can pay for. If you do, then you would pay our private care fees for those extra services.

1. Costs set by the Government (From 20 September 2025 to 31 October 2025)

A) The Maximum Basic Daily Care Fee (BDCF)

From 1/7/2019 Daughterly Care waived this cost, so the following information is for general information only.

When the Home Care Program launched it required all seniors to make a co-contribution to their in home aged care cost via the “Maximum Basic Daily Care Fee”. Strangely, it was never “a fee”, it was actually a co-contribution into your Home Care Package funding and available to be spent on your care.

The Maximum Basic Daily Care Fee, or co-contribution, for a senior on a Level 4 HCP is currently $13.49 per day, per person, so $188.86 per fortnight, per person i.e. $4,923.85 pa pp as at 20/9/2025. This represents 17.5% of the single person basic age pension. (This rate increases on the 20th March and the 20th of September each year in line with changes to the Age Pension) Source

Daughterly Care has not charged the Basic Daily Care Fee (BDCF) since 1/7/2019

In an effort to reduce the cost of a Home Care Package, the Government reduced the Maximum Basic Daily Care Fee for Seniors with a Level 1, 2 or 3 Home Care Package.

From 1/7/2019 Approved Providers who do charge a Basic Daily Care Fee will discount your Basic Daily Care Fee and the Government will pay Approved Providers that same discount which we will put into your Home Care Package. This means your Home Care Package income will remain unchanged despite the discount.

Current clients will NOT have their current hours of care, paid for by the Government, reduced as a result of this change because the Government has also announced it will pay us Approved Providers for the discount they have given Seniors. Seniors in receipt of a Home Care Package 1, 2 or 3 do not have to take any action.

Our clients do NOT pay a Basic Daily Care Fee, as per the Government’s announcement, the Government will also pay the discount for you, so your funding will slightly increase from 1/7/2019.

Let’s Just Make Life Easier

From 1/7/2019, rather than charge four different Basic Daily Care Fees, Daughterly Care has waived the Basic Daily Care Fee to zero for existing and new clients with a Home Care Package.

The Hardship Financial Supplement is then paid in addition to your Home Care Package funding. The Government may specify that the Hardship Financial Supplement standard is only for a set time, at which point you need to reapply. More information can be found at: https://www.health.gov.au/topics/aged-care/providing-aged-care-services/funding-for-aged-care-service-providers/hardship-supplement-for-aged-care

If you genuinely can’t afford to pay the Basic Daily Care Fee, then we strongly recommend applying for the Financial Hardship Supplement.

B) Income-Tested Care Fee for Part-Pensioners and Self-Funded Seniors

If you are a Part-Pensioner or Self-Funded Senior i.e. you earn the income listed below or more, you are still eligible to receive a Home Care Package, however, the Government requires you to pay an Income Tested Care Fee towards your Government Funding. Whatever your Income Tested Care Fee is, the Government reduces their funding of your Home Care Package by that same amount.

Will you pay an Income Tested Care Fee for your Home Care Package? (Are you a Pensioner, Part Pensioner or Self-Funded?)

If you earn the below income or less, then you are a Pensioner and pay no Income Tested Care Fee towards your Support at Home Care Package.

| Income Free Area (single person) | $34,762 pa |

| Income Free Area (Couple, Illness separated, single rate) | $34,034 pa |

| Income Free Area (Couple, Living together, single rate)

(relevant to Home Care only) |

$26,871.00 pa |

| Income Free Area (Couple, Living together, threshold for both)

(relevant to Home Care only) |

$53,742.00 pa |

|

If you earn more than the income in the income in the table above, and less than the table below, then you are a Part-Pensioner and pay part of the Income Tested Care Fee.

Daughterly Care cannot tell Part-Pensioners what their Income Tested Care Fee will be – only Services Australia can. Ask them to send you your Home Care Fee Letter. |

If you earn more than the income in the table below, you are Self-Funded and pay the Maximum Income Tested Care Fee. (source)

| Income Threshold (single person) | $66,960.40 pa |

| Income Threshold (Couple, Illness separated, single rate) | $66,232.40 pa |

| Income Threshold (Couple, Living together, single rate) | $51,142.00 pa |

| Income Threshold (Couple, Living together, threshold for both) | $102,284.00 pa |

You are 100% Self-funded if your yearly income is above the following thresholds:

- Single person – $66,960.40 income per annum

- Member of a couple, but now separated due to illness (individual income) – $66,232.40 pa. per person

- Member of a couple living together (single income) – $51,142 pa. per person, so that’s $102,284 of income per annum for the couple

But are you really Self-Funded? Read below.

What is included in your Income for the Purposes of Determining the level of the Income Tested Care Fee payable for your Home Care Package?

Income, for the purposes of in home aged care, is NOT the same as taxable income, it’s NOT even income received, because Financial Assets are DEEMED by Services Australia to earn a certain level of income.

Your assessed income includes:

- income from work

- income support payments from the Australian Government, such as the Age Pension, a Service Pension or an Income Support Supplement

- income from financial investments

- net income from rental properties

- War Widow(er)s Pension and some disability pensions

- net income from businesses, including farms

- superannuation and overseas pensions, income from income stream products such as annuities and allocated pensions

- family trust distributions or dividends from private company shares; and

- income from outside Australia.

If you have a partner, you will be asked to answer questions about your combined income. Your income will be assessed as half of your total combined income, regardless of whose name it is in.

Financial assets are deemed to be earning a set income and include bank accounts and other financial investments, like shares.

Money or assets that you (and/or your partner) have given away in the last 5 years, WILL be considered to earn you an income.

Deemed Income From Financial Assets from 20 September 2025

| Single | The first $64,200 of your Financial Assets has a deemed rate of earnings of 0.75% | Anything over $64,200 is deemed to earn income of 2.75% |

|---|---|---|

| Couples | The first $106,200 of your combined financial assets has a deemed rate of earnings of 0.75% | Anything over $106,200 is deemed to earn income of 2.75% |

Learn more about Deemed Income from Financial Assets

Use the Fee Estimator to estimate your Income Tested Care Fee – maybe you are NOT Fully Self-Funded for Home Care Package cost purposes.

Tip: The Fee Estimator tells everyone who uses it that they will pay the Basic Daily Care Fee. Daughterly Care waived this fee from 1/7/2019, so ignore that.

However it is good to estimate your Income Tested Care Fee here is the link:

https://www.myagedcare.gov.au/fee-estimator

Remember, as it says at the bottom of the My Aged Care Fee Estimator, to get your actual Income Tested Care Fee payable towards your Home Care Package you need to get assessed by Centrelink. Alternatively, you can talk to a Financial Information Service (FIS) Officer who will give you information about the financial aspects of aged care. You call 132 300 and say ‘Financial Information Service’ when they ask why you are calling.

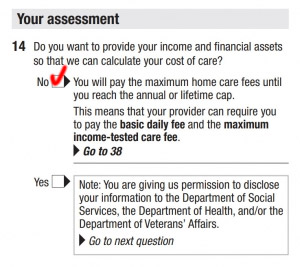

REALLY IMPORTANT TIME SAVING Tip for Fully Self-Funded seniors. Don’t complete the whole form if you are Self-Funded

If you are 100% certain, you are 100% fully self-funded, according to the way the Government calculates your income-for-aged-care-cost-purposes, then you do NOT need to complete the whole 19 pages of the SA456 form. Just complete Questions 1 to 13 and tick NO at question 14 and then jump to question 38. This saves completing all 19 pages and you pay the same maximum Income Tested Care Fee anyway.

This is the link to the 19 page Home Care Package Calculation of your Cost of Care (SA456) form: https://www.humanservices.gov.au/customer/forms/sa456

If you are in receipt of a Full Pension or Part-Pension, you just ring the Department of Human Services and ask them to send you your “Home Care Fee Letter” as they already know your financial details, but they need your details to be less than 2 years old. When the letter arrives it will say you have to pay a Basic Daily Care Fee, just ignore that because Daughterly Care waives that fee.

Rather than not receive a Home Care Package to help fund your in home care why not just advise that you are Non-Disclosed. A Level 3 or 4 Home Care Package is financially worthwhile even for fully self-funded older people.

Can’t afford to pay your Income Tested Care Fee?

Tip: If you are due to pay the Income Tested Care Fee but cannot afford it because, for example, some of your investments are frozen and cannot be accessed to pay your Income Tested Care Fee, it is possible to apply to the Government for a Hardship Financial Supplement i.e. they may then pay some or all of your Income Tested Care Fee to your Approved Provider for you.

The Hardship Financial Supplement is then added to your Home Care Package funding. The Government will specify that the Hardship Financial Supplement is for a set time, at which point you need to reapply. More information can be found at: https://www.servicesaustralia.gov.au/sa462.

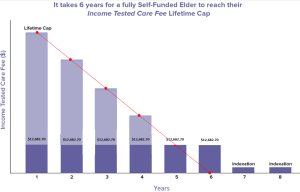

Limits on the Income Tested Care fee cost.

There are Daily, Annual and Lifetime Contribution caps on the Income Tested Care Fees. (20 September 2025 to 31 October 2025)

A safety net for part-pensioners and self-funded retirees

There is a maximum Income Tested Care Fee the Government requires Part-Pensioners and Self-Funded retirees to pay with a cap on the:

- daily;

- yearly; and

- lifetime

cost you pay towards your Home Care Package. This is a safety net to protect people who need aged care for more than 6 years.

The maximum contribution caps for the Income Tested Care Fee are:

| Fully Self Funded | Part Pensioner | |

|---|---|---|

| Daily Cap | $38.72 | $19.36 |

| Annual Cap | $14,095.20 pa | $7,047.55 pa |

| Lifetime Cap | $84,571.66 | $84,571.66 |

Once you have paid a total Income-Tested Care Fee contribution of $84,571.66 you will have reached your Lifetime Cap and you cannot be asked to pay any further Income-Tested Care Fees for in home care, or for Nursing Home care.

These caps on the Income Tested Care Fee cost are increased by inflation on 20 March and 20 September each year by the Government. Source

Special note for Part Pensioners

Daughterly Care cannot tell a Part-Pensioner what their Income Tested Care Fee is. You can get an estimate from the Fee Estimator Calculator or if the details Services Australia has on you are up to date, you can ring a Financial Information Service (FIS) Officer who will give you information about the financial aspects of aged care. You call 132 300 and say ‘Financial Information Service’ when they ask why you are calling. Ask for a copy of your ‘Home Care Fee Letter’ to be mailed to you.

It’s good financial planning to get this information after you are approved and while waiting for your Home Care Package to be assigned.

Good news: We have had many Pre 1 July 2014 seniors transfer their Home Care Package to us and they have ALL retained their concessional status and pay no Basic Daily Care Fee (BDCF) nor Income Tested Care Fee with Daughterly Care.

The Real Cost / Benefit of a Home Care Package for a Self-Funded Older Person (from 20 September 2025)

| Home Care Package Level |

Home Care Package minus Income Tested Care Fee (Fully Self-funded Retirees) |

Real Annual Benefit from Government per person for each year you live at home |

|---|---|---|

| Level 1 | $10,931.75- $10,931.75 | = $0 pa

i.e. zero benefit Ordinarily a Level 1 is of no financial benefit to a Self-Funded Senior. If you are an existing private client of Daughterly Care client, or have just been assigned a Home Care Package call us, we can make it financially neutral for you and the money you would have paid on private care counts towards your Lifetime Cap. |

| Level 2 | $19,224.55 – $14,095.2 | = $5,129.35 pa

This is the real Government funding for a Level 2 HCP. Costs such as the Package Management and Care Management fee need to be deducted from this balance, so in the ‘real world’ it is of little financial benefit to Fully Self Funded Seniors. If you are offered a Level 2 call us and we will make it worth your while. |

| Level 3 | $41,847.25 – $14,095.20 | = $27,752.05 pa |

| Level 4 | 63,440.65 – $14,095.20 | = $49,345.45pa |

2. Fees set by your Approved Provider

Case Management

Approved Providers charge a cost called “Care Management Fee”. This cost is to cover the time spent assisting you or your family to organise and manage your care and support services.

Contingency Fees

UP UNTIL 30/6/2019, the Government allowed Approved Providers to charge up to 10% pa as a contingency fee. Daughterly Care NEVER charged a Contingency Fee.

Contingency Fees are not a true fee. It is “quarantined money” put aside from your Government Funding and Consumer Contributions to pay for unplanned future care and support. Consider it “forced savings”.

TIP:

Up to the 27 February 2017, the Government allowed Approved Providers to KEEP for THEMSELVES all Unspent Funds inclusive of Contingency Fees that had accumulated in an Elder’s Home Care Package when the Elder no longer needed their package i.e. died or moved into a Nursing Home.

With that rule, all Approved Providers had a vested financial interest to charge the maximum 10% pa contingency fee for all clients. I have seen unspent balances of $23,000 while the “high care” client was forced to pay for extra care they needed privately, because their Rogue Approved Provider would not let them spend their $23,000 unspent Government Funding on their current high care needs.

Thankfully from 27 February 2017, all Unspent Fees including the Contingency Fee are returned to the Government to fund the care of other seniors.

Voluntary Top Up Fees

If the Government Subsidy does not cover all the consumer’s care requirements, and often it doesn’t, the Approved Provider will suggest that the consumer voluntarily pay private / voluntary funds to “top up” their Government subsidised Home Care Package.

WARNING:

When you pay the “Voluntary Top Up Fee” to your Old School Approved Provider, from statements I have audited, most Approved Providers also charge their administration and case management fees on the voluntary private care paid. Their average fee is 34% pa.

Daughterly Care does NOT charge a fee on Voluntary Top Up or Private Care fees or on Unspent Funds you transfer to Daughterly Care.

Most will keep a percentage of your voluntary / top-up care fees in administration and case management fees whereas the New Breed Approved Providers such as Daughterly Care Community Services do not charge Government or Approved Provider Fees on any privately paid care or voluntary contributions.

Therefore, I strongly recommend that you don’t buy “Voluntary Top up Care” through your Old-School Approved Provider, as typically you will lose 34% pa.

Example from a statement I audited:

The adult child was told $8,000pa of Voluntary Top Up Fees were needed. The adult child did not realise 39%pa was being kept of the $8,000 and Government Funding BEFORE any hours of care were bought. The client was able to buy 39% more care by buying those Voluntary Top Up hours direct from Daughterly Care as we don’t charge administration and case management fees on private care fees.

3. Home Care Package Costs for direct care bought or provided by your Home Care Package via the Approved Provider

Daughterly Care bonus: fees paid for private care do not attract Government set fees or Approved Provider fees. When you pay for private care you only pay for the direct care.

Daughterly Care charges ‘middle of the road’ fees for direct care provided by our very high quality of our Caregivers. Here is a link to the fees payable for direct care. When you have a Home Care Package the cost of direct care is paid by your Home Care Package up to a set number of hours depending your level of in home care package as you can see on this page.

Rather than miss out on Home Care Package funding, why not just tick that you are fully self-funded or a Non-Disclosed client. A Level 3 or 4 is definitely financially worthwhile even for self-funded retirees.

The Definitive Guide to Government Funded Consumer Directed In Home Aged Care Packages

1. What is a Consumer Directed Care (CDC) in Home Care Package?

2. How many hours of support or care can I receive for my Home Care Package?

3. What can a Government Subsidised Home Care Package pay for?

4. What are the costs of a Consumer Directed Care (CDC) Home Care Package? Current Page

5. What does Consumer Directed Care (CDC) Home Care Package mean?

6. Consumers’ 9 New Rights under Consumer Directed Care (CDC)

7. How do you apply for a Government Subsidised Home Care Package?

8. Are you approved or assigned a Government Funded Home Care Package?

9. Should Self-Funded Seniors accept a Level 2 Home Care Package?

10. Should Self-Funded Seniors accept a Level 3 or 4 Home Care Package?

11. Should a Pensioner accept a Level 1 or 2 Home Care Package?

12. How do I start my Home Care Package?

13. How do I transfer my Home Care Package to Daughterly Care Community Services?

14. How do I know if the Home Care Package fees I’m being charged are fair?

15. How will Consumer Directed Care (CDC) benefit my loved one?

16. Is Consumer Directed Care (CDC) working?

17. Will Consumer Directed Care (CDC) make it easier for my loved one to stay at home?

18. What happens to the Unspent Funds in my Government Funded / Subsidised Home Care Package?

19. If I hold a DVA Card can I have an In Home Care Package too?

20. Can I take leave from my Home Care Package?

21. Frequently asked questions about Consumer Directed Care (CDC) Home Care Packages

Discover the secret to getting more out of your Consumer Directed Care (CDC) Home Care Package!

Do you have a question that isn’t answered here or just looking for more information? Browse our FAQs.

5. What does Consumer Directed Care (CDC) Home Care Package mean?

Need more information? To know more about us, read why we started Daughterly Care, and take a look at our services.

Meet the stars of our business, our in home Caregivers and case managers and operations team.

Read unsolicited feedback from our clients. We’re always thrilled to receive such kind words.

Contact us for a confidential chat about your needs or to organise your, free no obligation consultation by emailing: claireg@daughterlycare.com.au or call us on (02) 9970 7333.