3. What can a Government Subsidised Home Care Package pay for?

Page 3 of 21

What can a Home Care Package pay for? Seeing as Home Care Packages are Consumer Directed you might think it can pay for anything you need or want; however that is NOT the case. Home Care Packages are funded by Tax Payers’ money, so they are “Consumer Directed within the Government’s Home Care Package Guidelines”. It is NOT as simple as, “if the item is on the list below, your Home Care Package can pay for it”. You need to get prior approval from your Care Manager and they will apply these tests:

- Does the service / item meet the Home Care Package Program Rule Guidelines? We read Dept of Health information so we have a deeper understanding than simply the list below.

- Does the service / item meet an ASSESSED CARE NEED RELATED TO FUNCTIONAL DECLINE, CAUSED BY AGEING & GOAL which are documented in your Care Plan?

- Is there sufficient Unspent Funds in your HCP available to pay for the service / item?

- When there are insufficient funds to meet all goals / needs / wishes, clinical care trumps all other wishes. When care needs increase your Home Care Package may need to cease paying for services that are non-care services so there is more budget to pay for clinical care and care services.

- The cost must represent value because tax payers are paying.

- Clinical CARE is always the top priority of your Home Care Package, then CARE, and then non-care services like lawn mowing, cleaning-only services etc.

- Is the service being provided by a family member or friend? Your family cannot be paid by taxpayers to pay for your care. Family provides free care because they are family and they love you.

Please: Do not organise any third party services unless your Care Manager has approved these services in advance. If you are unsure talk to your Care Manager.

This following list applies to all 4 levels of Home Care Packages.

Specified Inclusions

The following table provided by the Department specifies the care services that an Approved Provider of a Home Care Package service may provide.

The following services or items are inside the scope of the Home Care Package Programme and may be paid for by your Home Care Package IF approved by your DC Care Manager and the DC Home Care Package Program Manager.

| Care Services | ||

| Item | Service | Content |

| 1 | Personal services | Personal assistance, including individual attention, individual supervision and physical assistance, with:

a) bathing, showering including providing shower chairs if necessary, personal hygiene and grooming, dressing and undressing, and using dressing aids; b) toileting; c) mobility; d) transfer (including in and out of bed). |

| 2 | Activities of daily living | Personal assistance, including individual attention, individual supervision and physical assistance, with communication including assistance to address difficulties arising from impaired hearing, sight or speech, or lack of common language, assistance with the fitting of sensory communication aids, checking hearing aid batteries, cleaning spectacles and assistance in using the telephone. |

| 3 | Nutrition, hydration, meal preparation and diet | Includes:

a) assistance with preparing meals; b) assistance with special diet for health, religious, cultural or other reasons; c) assistance with using eating utensils and eating aids and assistance with actual feeding, if necessary; and d) providing enteral feeding formula and equipment. |

| 4 | Management of skin integrity | Includes providing bandages, dressings, and skin emollients and Registered Nurses to dress wounds. |

| 5 | Continence management | Includes:

a) assessment for and, if required, providing disposable pads and absorbent aids, commode chairs, bedpans and urinals, catheter and urinary drainage appliances and enemas; and b) assistance in using continence aids and appliances and managing continence. Please note your HCP cannot pay for continence aids if you are a participant of the CAPS Program. See Specified Exclusions List below. |

| 6 | Mobility and dexterity | Includes:

a) providing crutches, quadruped walkers, walking frames, walking sticks and wheelchairs; b) providing mechanical devices for lifting, bed rails, slide sheets, sheepskins, tri-pillows, and pressure relieving mattresses; c) assistance in using the above aids. |

The Definitive Guide to Government Funded Consumer Directed In Home Aged Care Packages

1. What is a Consumer Directed Care (CDC) in Home Care Package?

2. How many hours of support or care can I receive for my Home Care Package?

3. What can a Government Subsidised Home Care Package pay for? Current Page

4. What are the costs of a Consumer Directed Care (CDC) Home Care Package?

5. What does Consumer Directed Care (CDC) Home Care Package mean?

6. Consumers’ 9 New Rights under Consumer Directed Care (CDC)

7. How do you apply for a Government Subsidised Home Care Package?

8. Are you approved or assigned a Government Funded Home Care Package?

9. Should Self-Funded Seniors accept a Level 2 Home Care Package?

10. Should Self-Funded Seniors accept a Level 3 or 4 Home Care Package?

11. Should a Pensioner accept a Level 1 or 2 Home Care Package?

12. How do I start my Home Care Package?

13. How do I transfer my Home Care Package to Daughterly Care Community Services?

14. How do I know if the Home Care Package fees I’m being charged are fair?

15. How will Consumer Directed Care (CDC) benefit my loved one?

16. Is Consumer Directed Care (CDC) working?

17. Will Consumer Directed Care (CDC) make it easier for my loved one to stay at home?

18. What happens to the Unspent Funds in my Government Funded / Subsidised Home Care Package?

19. If I hold a DVA Card can I have an In Home Care Package too?

20. Can I take leave from my Home Care Package?

21. Frequently asked questions about Consumer Directed Care (CDC) Home Care Packages

Discover the secret to getting more out of your Consumer Directed Care (CDC) Home Care Package!

Do you have a question that isn’t answered here or just looking for more information? Browse our FAQs.

Support services

The following table provided by the health Department specifies the support services that an Approved Provider of a Home Care Package service may provide.

| Support services | ||

| Item | Service | Content |

| 1 | Support services | Includes:

a) cleaning; b) personal laundry services, including laundering of care recipient’s clothing and bedding that can be machine-washed, and ironing; c) arranging for dry-cleaning of care recipient’s clothing and bedding that cannot be machine-washed; d) light gardening for safe access to the home; e) medication management; f) rehabilitative support, or helping to access rehabilitative support, to meet a professionally determined therapeutic need; g) emotional support including ongoing support in adjusting to a lifestyle involving increased dependency and assistance for the care recipient and carer, if appropriate; h) support for care recipients with cognitive impairment, including individual therapy, activities and access to specific programs designed to prevent or manage a particular condition or behaviour, enhance quality of life and provide ongoing support; i) providing 24-hour on-call access to emergency assistance including access to an emergency call system if the care recipient is assessed as requiring it; j) transport and personal assistance to help the care recipient shop, visit health practitioners or attend social activities; k) respite care; l) home maintenance, reasonably required to maintain the home and garden in a condition of functional safety and provide an adequate level of security such as cleaning gutters; See Specified Exclusion list to get an idea of modifications that cannot be paid by your HCP; m) modifications to the home, such as easy access taps, shower hose or bath rails i.e. small modifications; See Specified Exclusion list below to get an idea of modifications that cannot be paid by your HCP. n) assisting the care recipient, and the homeowner if the home owner is not the care recipient, to access technical advice on major home modifications; o) advising the care recipient on areas of concern in their home that pose safety risks and ways to mitigate the risks; p) arranging social activities and providing or coordinating transport to social functions, entertainment activities and other out-of-home services; q) assistance to access support services to maintain personal affairs. |

| 2 | Leisure, interests and activities | Includes encouragement to take part in social and community activities that promote and protect the care recipient’s lifestyle, interests and wellbeing. |

Clinical Services

The following table provided by the Department specifies the care services that an Approved Provider of a Home Care Package service may provide.

| Clinical services | ||

| Item | Service | Content |

| 1 | Clinical Care | Includes:

a) nursing, allied health and therapy services such as speech therapy, podiatry, occupational or physiotherapy services; b) other clinical services such as hearing and vision services. |

| 2 | Access to other health and related services | Includes referral to health practitioners or other related service providers. |

If you need clinical care such as services provided by Registered Nurses or Allied Health staff (such as a Physio, Occupational Therapist, Dietician, Podiatrist) the Government Guidelines are very clear that clinical care must be prioritised over less essential services such as gardening or cleaning.

| Service inclusions | Content |

| Care management | Includes:

ongoing assessment and planning undertaken on at least a monthly basis to ensure that the care recipient receives the care and services they need. This includes: · regularly assessing the care recipient’s needs, goals and preferences · reviewing the care recipient’s Home Care Agreement and Care Plan · ensuring the care recipient’s care and services are aligned with other supports · partnering with the care recipient and the care recipient’s representatives about the care recipient’s care and services · ensuring that the care recipient’s care and services are culturally safe · identifying and addressing risks to the care recipient’s safety, health and wellbeing. |

Excluded items that your Government Subsidised Home Care Package cannot pay for

Section 2 – Specified Exclusions

The Quality of Care Principles 2014 lists those care & services that must not be included in the package. These are always excluded; even if they may advance the care recipient’s assessed ageing related care needs and goals, as they are not aligned to the intent and scope of the Home Care Package program.

The following items must not be included in a package of Care and Services under the HCP Program.

| Exclusions | Examples |

| Services, goods or supports that people are expected to cover out of their general income throughout their life regardless of age

Another way to think of this is that your HCP cannot pay for general living expenses that are unrelated to your assessed needs and goals in your Care Plan. |

· General home services that were never, or are generally not completed independently prior to age-related functional decline, including home repairs/maintenance/specialist cleaning performed by a tradesperson or other licensed professional

· Food (except as part of enteral feeding requirements or items listed under food for special medical purposes as per the Australia New Zealand Food Standards Code – Standard 2.9.5). Further information on food is below under Meal services · Home insurance · Rates · Water, sewage, gas and electricity costs · Private transport related costs including vehicle registration, vehicle repairs, vehicle insurance and petrol · Local transit costs of public bus, ferry or train fares · Funeral plans / insurance costs · Pet care and associated costs such as pet food; registration; taxidermy, cremation · Internet and telephone costs, exceptions include: o Care recipients who are homeless or at risk of homelessness (as identified in a care recipient’s ACAT assessment) can use HCP funds for the ongoing monthly charges to ensure connection with service providers o Care recipients who require the internet or landline to support delivery of medication management, remote monitoring service or delivery of an included service on the phone can use HCP funds to set-up telecommunications connections (e.g., to get internet connected) · Beauty therapy (e.g., manicures) and hairdressing · Cost of entertainment activities, such as club memberships and tickets to sporting events · Travel and accommodation for holidays · Supplies to participate in any activity, e.g. gardening or craft · Using HCP funds to pay for solicitors or accountants for maintaining care recipients’ personal affairs · Gym or pool memberships/access costs when not prescribed for aged-related functional decline and monitored by health professional operating within their scope of practice |

| Accommodation costs | · Assistance with home purchase

· Mortgage payments · Rent · Permanent residential care (subsidised or private) and residential respite (subsidised) · Heating and cooling costs (installation and repairs) · Whitegoods and electrical appliances (except items designed specifically for frailty such as a tipping kettle) · Household furniture and furnishings: o lounge suites and recliners which do not support a care recipient’s mobility, dexterity and functional care needs and goals o Other general household furniture such as coffee tables, wardrobes, and bookshelves. o Massage chairs when not prescribed by treating medical practitioner and/or allied health professional o General mattress and frame for bed (exceptions for pressure relieving mattress or mattress/frame for an electrical adjustable bed or hospital bed) · Replacement/maintenance/servicing/cleaning of: o Water tanks o Solar panels o Fencing o Roofs o Heating and cooling or hot water systems o Swimming pools · Home modifications or capital items that are not related to the care recipient’s ageing-related care needs, for example: o Windows, roofs, pergolas, sunrooms, decking o Home modifications that don’t support ageing safely e.g., non-accessible bathroom and kitchen modifications; non-standard fittings in accessible bathroom modifications (e.g., mosaic tiles) o Home modifications requiring development applications o Aesthetic modifications of any kind o Repainting the home o Major plumbing o Emptying of septic tank; remedying sewage surcharge (matter for water company/insurer) o Major electrical work, e.g., rewiring house o Replacement of entire floor and floor coverings throughout the home unless safe passage for mobility equipment required or slip hazard reduction required, as recommended by a health professional for care recipients at risk of falls o Replacement of foundation e.g., concrete/cement slab o Significant changes to the floorplan of the home, such as adding a new bathroom or extension · Extensive gardening services such as: o Planting and maintaining crops, natives and ornamental plants o The installation and/or maintenance of raised garden beds o Compost heaps o Watering systems o Water features and rock gardens o Landscaping o Tree removal o Removal of garden beds o Removal of shrubbery (unless preventing safe access and egress) |

| Payment of home care fees | · Defined at section 52D of the Aged Care Act 1997

· Includes income tested care fees, basic daily fees and additional fees |

| Payment of fees or charges for care or services funded or jointly funded by the Australian Government | · Co-payments for state/territory government funded programs, such as subsidised taxi vouchers and/or aids and equipment schemes

· Dentures, dentistry and dental surgery · Prescription glasses or contact lenses · Prostheses (e.g., artificial limb) · Spectacles · Hearing aids available under the Hearing Services Program (HSP). Contact the Hearing Service Program (HSP) for guidance on hearing aid replacement and delegate approval for non-standard hearing aids. Exception if care recipient is not a pension concession card holder as HCP may cover like for like of typical hearing aid covered by HSP in this case only. · Continence aids if a participant in the Continence Aids Payment Scheme (CAPS) program · Diagnostic imaging · Natural therapies, including: o Alexander technique o Aromatherapy o Bowen therapy o Buteyko o Feldenkrais o Homeopathy o Iridology o Kinesiology o Naturopathy o Pilates (except sessions supervised by an exercise physiologist or physiotherapist) o Reflexology o Rolfing o Shiatsu o Tai chi (except sessions supervised by a Chinese Medicine Practitioner, exercise physiologist or physiotherapist) o Western herbalism o Yoga (except sessions supervised by an exercise physiologist or physiotherapist) · Payment for informal care, eg family, friends – a Carer’s Payments is available to fund the support of family and friends. · Section 16.1 of the HCP Program Manual specifies more information about what ageing related programs can and cannot be accessed while receiving a HCP. |

| Payment for services and items covered by the Medicare Benefits Schedule (MBS) or the Pharmaceutical Benefits Scheme (PBS) (or items that should be considered for funding through these schemes) | · Co-payments or gap fees, including for services covered by private health insurance.

· Medications, vitamins and supplements (as well as items not covered by the PBS such as off-indication prescriptions, medicines not endorsed for listing by the Pharmaceutical Benefits Advisory Committee (PBAC) or medicines where the manufacturer has chosen not to list the product on the PBS · Consultation/tests/surgery with medical practitioner (GPs and specialists) – The only exception to this is a private appointment (i.e. not covered by MBS) with a GP to meet evidence requirements for the dementia and cognition supplement and oxygen and enteral feeding supplements. Please note Daughterly Care provides free assessment a your home for he cognition supplement. · Hospital costs · Ambulance cover · Private health insurance premiums |

| Provision of cash debit cards or like payments to care recipients for any purpose | · Debit cards (unless the provider has rigorous systems in place to vet every payment and keep on file all receipts in accordance with the Records Principles 2014. Debit cards may pose issues for GST credits. Consult with the ATO for more information).

· Cash payments or gift vouchers/cards, including online vouchers and coupons · Transfer of subsidy into care recipient or their family’s personal/business bank account without rigorous acquittal by provider of funds against receipts matched to the Home Care Agreement, Care Plan and Individualised Budget in accordance with the Records Principles 2014. |

Guidance on allied health from the Department of Health

Introduction

This guidance is intended to assist home care providers and home care recipients to understand the allied health services which can and cannot be funded through a Home Care Package (HCP).

Information on allied health can be found on the Department of Health and Aged Care’s website at: https://www.health.gov.au/health-topics/allied-health/

Allied Health

HCP funds CAN be used for allied health services but must only be used when the service is:

- required due to care recipient’s age-related functional decline or to assess the need for aids and equipment

- delivered by an accredited provider, and

- not concurrently being funded by another government program.

Age-related functional decline

Age-related functional decline can be defined as a reduction in ability to perform activities of daily living (e.g., self-care activities) due to a decrease in physical and/or cognitive functioning associated with ageing.

Aids and equipment

Recommendations for aids and equipment, care and services may be funded under the HCP, provided they meet the other requirements of the inclusions and exclusions framework.

Goods, Equipment and Assistive Technology (GEAT) are available as part of a Home Care Package where there is an assessed need.

o Health professionals operating within their scope of practice may assess for GEAT. For further guidance on suitability of a health professional to assess for an item, consult Department of Veterans’ Affairs Rehabilitation Appliances Program at https://www.dva.gov.au/sites/default/files/2022-03/rap-schedule-march-2022.pdf (for reference purposes only – noting not all equipment covered by DVA is available under HCP).

Accreditation and criminal history checks

Allied health providers must meet their respective accreditation and registration requirements and operate within the scope of practice of their regulated or self-regulated body. Depending on the respective accreditation and registration requirements, this may permit activities being undertaken by allied health assistants.

Example 1: Speech pathologists funded under the HCP Program must hold the Speech Pathology Australia Certified Practising Speech Pathologist credential.

Example 2: HCP funds can be used to pay for treatment from a registered podiatrist but not for a reflexologist which is not an accredited or registered profession.

Not all allied health professions are registered with Ahpra. Some are self-regulated by a national professional association. The Ahpra regulated professions must adhere to the Criminal History Registration Standard, which requires the applicant to declare their criminal history on initial registration, and upon annual renewal disclose any changes to their criminal history. The self-regulated professions vary in whether they require professionals to declare criminal history on registration and/or renewal.

As there is not yet a consistent standard across the diverse allied health professions in regard to criminal history checks, a provider must seek this from prospective allied health employees to meet the requirements under the Accountability Principles 2014.

It is standard practice for allied health professionals to provide this on engagement with state and territory employers (such as in the form of a police check) and is then often maintained on a regular basis through credentialling requirements. Most allied health professionals are expected to maintain a working with vulnerable people check for any employment in a public setting, so this rule is not likely to be an impost to accessing allied health. Providers should consider seeking the following documentation from the allied health professional:

- Police check; or

- In some jurisdictions, a working with vulnerable people card may satisfy the requirements of the Accountability Principles 2014. However, providers should check with their relevant jurisdiction if this card is based on a police check no older than three years, and screens out persons who were convicted of murder, sexual assault; and conviction and imprisonment for any other form of assault; or

- NDIS worker screening clearance.

Other government programs

HCP funds CANNOT be used for allied health services when the service is:

- rebated by Medicare Benefits Schedule (MBS) or their private health insurance (even if only partially)

- treating a lifelong disability (except where trajectory is impacted by ageing e.g., post-polio syndrome)

- treating a short-term illness or chronic health condition where ageing is not a confounding factor to the severity of the condition

HCP funds cannot be used for allied health if the services are not related to age related functional decline, and/or the service is also being funded by another Government funding program such as the Medicare Chronic Disease Management program. Care recipients with a chronic (or terminal) medical condition, which is being managed by their GP, can access Chronic Disease Management through the MBS.Information on Chronic Disease Management – Individual Allied Health Services under Medicare can be found at:https://www1.health.gov.au/internet/main/publishing.nsf/Content/health-medicare-allied-health-brochure.htm

Care recipients should work with their provider to identify the best way to use their HCP funds alongside other funding streams.

Example: A care recipient with Type II diabetes who is eligible for a Chronic Disease Management Plan through the MBS should make use of this plan first to access allied health and diabetes nursing services. When all access to allied health and nursing is exhausted under this plan and further support is required to address ageing related functional decline (if a confounding factor to the diabetes diagnosis), a care recipient may access these services through the HCP.

Psychology

Psychology services may be covered under Medicare’s GP Mental Health Treatment Plans if the GP considers the care recipient has a diagnosable mental disorder and should be used in the first instance. Where these supports are exhausted and access to a psychologist is required for ageing related functional decline, this may be funded under the HCP. Psychiatry is a strict exclusion.

Acupuncture

Some GPs practice acupuncture and if available care recipients must go through their GP or other primary care provider to access this under the MBS.

Providers should only fund acupuncture where it can be demonstrated that the practitioner is an Ahpra registered Chinese Medicine Practitioner, and that the care recipient is not using private health insurance. Care recipients are still expected to seek advice from their GP before engaging in acupuncture as a suitable treatment.

Acupuncture may then be provided through a HCP where it meets the person’s assessed care needs, it can be identified in their care plan and must fit within the available budget for their package level.

Gap Payments

Gap payments cannot be charged to the HCP budget, as many gap payments relate to services that are also funded or partly funded by the Australian Government, such as the MBS and the PBS.

While health insurers are not precluded from paying a benefit when the treatment is eligible for other benefits (e.g., HCP funds), many do not pay benefits for services funded by other programs. Private health insurers can pay benefits for various goods and services under general treatment. General treatment cover provides benefits for allied health service providers. There are various limits that may apply, for example a maximum amount or percentage limit per service, per year, or lifetime limits. Health insurers usually find it necessary to limit these benefits to keep the cost of policies affordable.

How can package funds be used to make large purchases (i.e., the cost exceeds monthly subsidy/fees payable), such as assistive aids, equipment and accessible home modifications, for care recipients?

Large purchases, defined as those items where the cost exceeds the monthly subsidy/fees payable such as assistive aids, equipment and accessible home modifications, must be:

- agreed within the care recipient’s care plan;

- be within the available budget for the package level, with any charges or additional service fees mutually agreed with the care recipient through the Home Care Agreement before purchase:

- be related to the care recipient’s ageing related care needs, which may require an assessment from a health professional operating within their scope of practice e.g., an occupational therapist, physiotherapist or registered nurse to ensure the aid/equipment/home modification is fit for purpose.

o The cost of the assessment by the health professional may be covered by the existing charges for care management or direct service charge.

o In considering suitability of what type of health professionals should make the assessment, providers are to make use of their clinical judgement or alternatively can consult the following resources from other Australian Government programs for guidance on comparable health professional assessors for aids and equipment:

- Department of Veterans’ Affairs Rehabilitation Appliances Program athttps://www.dva.gov.au/sites/default/files/2022-03/rap-schedule-march-2022.pdf (for reference purposes only – noting not all equipment covered by DVA is available under HCP).

- Providers may also wish to review the product list for the geat2GO program for the Commonwealth Home Support Programme athttps://www.indigosolutions.org.au/docs/default-source/geat/geat2go-product-list-june-2022.xlsx?sfvrsn=9a17b1d5_2 which characterises products under General, Under Advice, Physiotherapist and Prescribed.

Providers can access unspent funds (including the home care account balance) to pay for large purchases.

Where a care recipient has transferred providers, their home care account (including any returned provider held Commonwealth unspent funds) will be under quarantine for a 70-day period – the new provider must wait until day 71 (release of unspent funds) to make the purchase.

Providers must not split the cost over multiple claim months unless the item is being leased.

Where a care recipient has paid upfront for an allowable item, the provider may only reimburse them within the relevant claim month. If a care recipient moves to a new provider and they obtained an item from their previous provider, a care recipient cannot seek reimbursement from their new provider.

Example 2. Petro has an unspent funds balance of $10 and receives a monthly subsidy of $704.20 and pays fees of $282.24 monthly. He has been assessed as requiring an accessible bathroom modification which will cost around $20,000. His provider advises him that this purchase cannot be made until he has accrued sufficient unspent funds and must be weighed up against the risk to his wellbeing of him not receiving other care and services such as wound management and transport to social activities. His provider discusses with him more affordable options, such as an over the toilet frame, to meet his aged care needs in the interim.

Where the cost exceeds available funds for the care recipient, like in Example 2, providers and their care recipients can:

- charge the care recipient additional service fees (agreement and consent required) to make up the difference – however, it is important to note that once additional services fees are charged, there is no capacity to use HCP funds to recompense the care recipient;

- postpone the purchase until there are sufficient funds to cover the costs – this is DC’s approach;

- enter leasing arrangements (including to lease to buy) where appropriate; and

- if not on Level 4, arrange a Support Plan Review through an ACAT if the package is over-allocated through the provision of monthly care and services; and the need for the large purchase is crucial.

There are certain circumstances where a HCP care recipient can access CHSP services over and above the services provided through the HCP budget. This will be subject to the available capacity of CHSP providers and their available funding, given CHSP clients will be the priority. Care recipient contributions, additional to income tested care fee and basic daily fee, may apply.

Considerations for home modifications

Home modifications must only be provided to improve safety and accessibility and promote independence (e.g., widening doorways for wheelchair access, removing shower hobs).

Works must be recommended by a health professional operating within their scope of practice and tailored to the ageing-related needs of the care recipient. Any works completed must align with the recommendations of the health professional. All work must be conducted by a qualified tradesperson with appropriate licensing and insurances as per state/territory government laws. Building work must be in line with the Building Code of Australia.

If a care recipient departs HCP unexpectedly, any remaining balance for the works, provided works were agreed to before date of departure, can be reconciled from the home care account within the 70-day period from date of cessation only.

What happens if the care recipient is not the homeowner or changes are required to common property covered by strata?

HCP funds can be used for modifications relating to the care recipient’s ageing related needs when they are not the owner of the property, or modifications are needed to be made to common property in a strata where safe egress and access is required for the care recipient.

To avoid disputes, it is prudent for the provider to ascertain the ownership/management of any premises prior to agreeing to use HCP to fund any works to modify the property. The provider should also seek assurances that the care recipient’s residence at the premises is secure and stable. However, this needs to be balanced against their current care needs and goals. For example, if a grab rail will prevent a fall, even if the care recipient has only been able to secure residence for a short period of time or is nearing the end of a lease agreement, and if the package budget allows it, this may still be a good investment of HCP funds. Conversely, it may not be prudent to modify a bathroom or a kitchen to make it more accessible if the care recipient does not have security of residence.

However, any changes to common property in a strata complex to assist a care recipient’s egress and access needs must be considered carefully. It is a poor outcome if the care recipient pays for the whole modification when others will benefit; and is risked being devoid of funds for personal care and/or other services. Negotiation should take place to understand what portion the strata will pay, and whether there is option for the strata to pay for the whole project if it benefits multiple residents also requiring safe egress and access from the building. It is also advisable to seek advice from the state/territory government body responsible for strata to understand the body corporate’s responsibilities under the Disability Discrimination Act 1992, noting the operation of this Act may vary across jurisdictions.

Providers and care recipients should also consider that the nature of how HCP funds are paid means that if a care recipient departs the Program there is no capacity to access HCP funds to return the property to its state before the modification. Thus, it must be made clear to any landlord/strata that all modifications will be considered permanent unless private arrangements with private means are made between the care recipient and owner/management.

Clarification About Meals

*Meals – The government subsidy for a Home Care Package can be used to pay for the preparation and delivery of meals. This could be through the consumer’s home care provider, a CHSP service provider (for example, under a sub-contracting arrangement with the home care provider) or by a private service provider. However, the consumer is expected to pay for the cost of the food. Services such as Meals on Wheels ask the consumer to pay for the food and the consumer can ask for their Home Care Package to pay for the preparation and delivery, when it is itemised separately on the invoice.

Your Home Care Package can pay for a Caregiver to shop for ingredients and to prepare your meals, however the senior must pay for the food from their own money.

GST and Home Care Packages

Every service or item your Home Care Package pays for is GST-free. We pay the whole bill inclusive of the GST but we only deduct the net GST-free amount from your Home Care Package. Our Handling Fee for paying Third Party Services is 10% (equivalent to the GST you would have paid).

Remember Private in Home Care has no limitations like the excluded items list above.

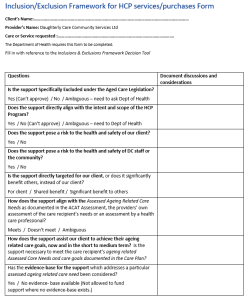

Here is a framework that you and your Care Manager can use to help you decide if your Home Care Package can pay for the item/service you would like.

Inclusion/ Exclusion Framework for HCP services/purchases Form

You can click on this image to download a PDF of this 2 page form.

This is a link to the Inclusions & Exclusions Framework Decision Tool referred to in Inclusion/Exclusion Framework for HCP services/purchases Form

4. What are the costs of a Consumer Directed Care (CDC) Home Care Package?

Meet the stars of our business, our in home carers and case managers and operations team.

Read unsolicited feedback from our in home care clients. We’re always thrilled to receive such kind words.

Contact us for a confidential chat about your in-home care needs or to organise your free no obligation consultation by emailing: claireg@daughterlycare.com.au or ring us on (02) 9970 7333.