Last week a number of friends texted and emailed me to ask:

“I saw in the media that elderly people are getting slugged an Exit Fee – of $4,153 [1] just for leaving the current provider of their Home Care Package. Kate, is that really true?”

I replied:

“yes, unfortunately large Exit Fees are being charged by some Old-School Home Care Package Providers.

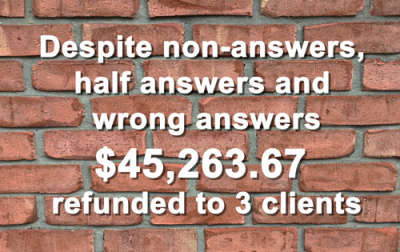

I call it “kicking your ex-client in the guts on the way out the door”. But frankly, Exit Fees are the least of Elders’ worries compared to the ongoing overcharging errors and secret fees I have found which have been refunded to 3 Daughterly Care clients totalling $45,263.67.”

Unfortunately, there are Old-School Approved Providers of Government Funded Home Care Packages who charge really high Exit Fees if you dare to exercise your right to choice and move your Government Subsidised Home Care Package away from them to a New-Breed of Approved Provider like Daughterly Care Community Services.

The highest Home Care Package Exit Fee on the Government’s website is a whopping $4,153 charged by a not-for-profit, the Royal Free Masons Home Care in Victoria.

In this valuable blog, I will arm you with information and knowledge so you don’t get ripped off by High Exit Fees. This blog explains:

1. what is a Home Care Package Exit Fee?

2. how Exit Fees cost you from day one of your Home Care Package, not just when you exit;

3. where Exit Fees came from – the more disturbing story and how they distort customer service;

4. most importantly, I’ll teach you the two ways to make sure that you never pay an Exit Fee ever; and

5. you’ll learn about the secret 10% pa to 15% pa fee costing you far more than a once off Exit Fee.

I have audited hundreds – and I mean hundreds of Home Care Package Monthly Statements for elderly people from all around Australia.

Two years ago, I got out my calculator, pulled up my sleeves and dove deep into auditing the Monthly Statements of Elderly people receiving a Government Subsided Home Care Package provided by Approved Providers.

I still audit Home Care Package monthly statements for my existing and new clients to help them make a fully informed decision on whether to move their Government Subsidised Home Care Package to Daughterly Care or not.

Whilst I have helped many people by auditing their monthly statements free of charge in the past, the truth is I did it for purely selfish reasons. I wanted to know what was happening in the ‘real world of Government Subsidised Home Care Packages’ so that I could best help my clients.

What I found shocked me.

Not for one minute did I expect Old-School Approved Providers to charge Elderly people the way they do.

Not all – just many.

What I found was disturbing and at times made me feel physically sick because I would often find that an Elderly person had a large sum of unspent Government funding being “held back” in their Home Care Package by their Approved Provider, despite repeated requests for more care.

1) What is the Home Care Package Exit Fee for?

In theory, Exit Fees are charged to cover the costs of exiting or discharging a client from their Government Subsidised Home Care Package. It is to cover the cost of:

1. working out how much the client paid in advance for care as that needs to be refunded to the client or their estate;

2. calculating how much of the Government Funding remains unspent and needs to be transferred to the clients’ new Approved Provider or returned to the Government;

3. to cover the cost of cancelling services; and

4. to assist a client to move into a residential nursing home because they can’t afford or don’t want around the clock in home care required in the final months / years of their life.

Each month, you have to report to the client what their unspent Home Care Package funds is. It beggars belief that some Old-School Approved Providers believe it costs them $4,153 or even $750 to bring last month’s balance up-to-date and to make a few phone calls to cancel booked services.

2) How Exit Fees cost you from day one of your Home Care Package, not just when you exit.

What you can see from the Home Care Package flow of money table below is that the big problem with high Exit Fees e.g. $4,153 is that Approved Providers need to build up UNSPENT FUNDS in the client’s Home Care Package so that they CAN collect their Exit Fee from it. Given a client can leave at any time, Old-School Approved Providers need to build up unspent money as quickly as possible and maintain that level of unspent funds until you exit.

So Exit Fees reduce the money available for your care from the day they are implemented, they don’t just cost you when you leave, that’s why I don’t like High Exit Fees – they distort Approved Provider behaviour and reduce support available.

The Money Flow of a Home Care Package.

| Opening balance of Unspent Home Care Package = |

| + plus Government Funding |

| + plus Client Co-Contribution (also called Basic Daily Care Fee) |

| + plus Client Contribution (Income Test Care Fee if self funded or part pensioner) |

| + plus Client Contribution (Voluntary or Top Up Fees if extra care is needed) |

| Less Approved Provider Fees (Allowed by the Government) Administration Fees |

| Less Approved Provider Fees (Allowed by the Government) Case Management Fees |

| Less Approved Provider Fees (Allowed by the Government) Core Advisory Fees |

| Less Approved Provider Fees (Allowed by the Government) Contingency Fee (capped at 10% pa) |

| Less Approved Provider Fees (Allowed by the Government) Exit Fee (once off) |

| Less Approved Provider Fees (I have seen e.g. $2,000 Set Up Fee; 3 quarterly review fees 1 annual review fee) all in addition to the 35% pa case management and administration fee being charged to the client. |

| Less 10% GST incorrectly charged. See blog. |

| Less 10% – 15% Secret Undisclosed Hidden Fees. See blog. |

| = Equals budget left for care |

| Less cost of ACTUAL Care and Support Services for the month |

| = Unspent funds carried forward to your next monthly statement (Old-School Approved Providers need to make sure this Unspent Balance exceeds their Exit Fee; otherwise they can’t collect their Exit Fee.) |

3. Where Exit Fees came from… the more disturbing story.

What the public don’t understand, and what I didn’t understand until I started auditing Home Care Statements, is that Old-School Approved Providers have always enjoyed “Exit Fees” – often far in excess of the $4,153 reported in the press.

Prior to 27 February 2017, Old-School Approved Providers regularly enjoyed massive “Exit Fees” because any unspent Government Funding in the client’s Home Care Package when the client died or was placed into a Nursing Home was KEPT entirely by the Old-School Approved Provider.

Let me write that for you to read again!

The Old-School Approved Provider who was determining or managing your Home Care Package Budget and telling you whether they would pay for extra care or not, kept 100% of the unspent Government funding that they had not let you spend!!!

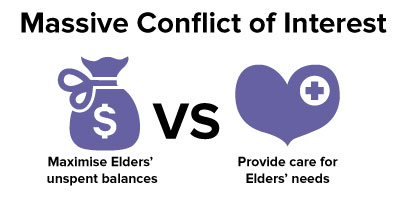

How did the Government expect Old-School Approved Providers to manage the client’s Home Care Package money in the best interest of the client, and at the same time ignore their own significant financial conflict of interest to maximise unspent fees when they kept 100%?

Now remember, the higher the unspent Home Care Package balance – the more income kept by the Approved Provider when that client died or was placed into a Nursing Home.

The fact is prior to 27 February 2017, Old-School Approved Providers had an undeniable financial conflict between maximising their own income by building up Home Care Package unspent balances versus giving the client the extra care they requested. They had a MASSIVE conflict of interest.

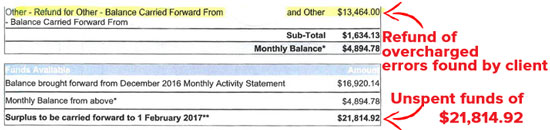

The worst case of maximised UNSPENT GOVERNMENT FUNDING that I have personally seen was a whopping $21,814.92 as at January 3rd, 2017.

I know that is unbelievable therefore, here is a snip of the statement so you can see it for yourself.

This client was recently placed into a Nursing Home because the family were exhausted and could not afford in home respite care – well, I guess not, when your Approved Provider is “holding back” $21,814.92!!!

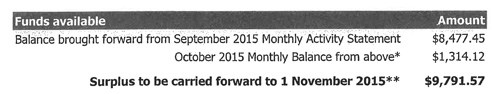

Another example I saw from the same Approved Provider was $9,791.57 unspent Government Funding.

This client with high care needs was denied extra care and his wife told she had to pay for private care services even though he had …wait for it….$9,791.57 in unspent Government Funding sitting in his Home Care Package in the Approved Provider’s bank account.

That made me so angry because his wife had to go to work to earn money, pay significant income tax and with her after-tax income buy private care when he already had $9,791.57 unspent Government funding sitting in his Home Care Package in the Approved Provider’s bank account.

What the public doesn’t understand is that Old-School Approved Providers have commonly enjoyed big financial wins when an Elderly person died or was placed into a Nursing Home.

Indeed had the client with the unspent balance of $21,814.92 been placed into a Nursing Home before 26 January 2017, the Old-School Approved Provider would have kept that $21, 814.92 “exit fee”. I can’t believe the Government only put a stop to this conflict of interest on the 27 February 2017.

Thank goodness the Productivity Commission examined the Government Funded Home Care industry and identified that this practice had to stop! Private care suppliers like Daughterly Care have never operated this way.

Starting from the 27th of February 2017, any unspent money in an Elder’s Home Care Package is returned to the Federal Government to provide care for other Elders, instead of becoming income for Old-School Approved Providers!!!

Now that makes financial sense doesn’t it, especially when the Government is telling us how financially strapped our nation is.

Commonly the unspent funds retained by Old-School Approved Providers when an Elder dies or is placed into a Nursing Home… that I have personally seen on their statements has been between $6,000 and $10,000 per client.

I thought the mandatory refunding of all unspent balances to the Government was the end of that financial conflict of interest…

…then the Old-School Approved Providers successfully lobbied the Federal Government to be able to charge Exit Fees when an Elder left them and moved their Government Funding to another Approved Provider of Home Care Packages or moved to a Nursing Home or passed away.

In other words, if an Elder DARED to exercise choice just as Consumer Directed Care was designed to enable them to do…

…the Approved Provider can now charge an uncapped Exit Fee so long as they have disclosed the Exit Fee in the client’s signed Home Care Agreement.

By the way, this is why Old-School Approved Providers have been re-visiting their clients and asking them to sign a new Home Care Agreement; one which includes a new Exit Fee and perhaps some other new fees too.

I have recommended Daughterly Care clients “DO NOT SIGN A NEW HOME CARE AGREEMENT unless you are happy to stay with your Current Approved Provider and you are happy to pay their new Exit Fee”.

Approved Providers are required to disclose their Exit Fee on the Government’s Home Care Package Service Finder website.

“Daughterly Care hasn’t charged our private care clients an Exit Fee for the last 21 years and just because the Government has been lobbied to allow Exit Fees – we are not going to start charging one now.

We provide great service for good value. That’s what wins and retains clients, not artificial barriers like Exit Fees”.

High Exit Fees distort and reduce the customer service offered by Approved Providers.

How do Exit Fees distort behaviour? Unspent balances provide free “working capital” for Approved Providers. Instead of allowing clients to spend their unspent balances on the care they need, Old-School Approved Providers have a financial reason to limit services in order to ensure they have funds to pay for their Exit Fee.

Recent Case of denying services despite high unspent fees.

Only 3 weeks ago, a client’s spouse knew they had over $6,600 unspent Home Care Package funding because the recent Monthly Statement had arrived in the mail. Daughterly Care was asked by the spouse to take the client to the Podiatrist. We jumped and made that happen, then the spouse called the Old-School Approved Provider that same day and was told “no you have to pay for those 2 hours privately”.

Why should that couple have to pay privately when they have $6,600 unspent Government Funding?

After the refusal they decided it was time to exercise their right to move to a New-Breed of Approved Provider so they called Daughterly Care and said, “transfer my spouse’s Home Care Package to you”.

Why did this client transfer to us?

Simple. Having been a private home care provider for 21 years, we have:

- uncommon common sense;

- we care about our clients (not just care for them) and so we listen to them and stand in their shoes before we answer their requests.

So in that situation our answer would be informed, consumer focused and meet Government’s Home Care Package rules:

“Let me just look up your balance. Oh you have an unspent balance of $6,600 and because taking your spouse to the Podiatrist is in line with the Care Plan goals, that is not a problem.”

We work with our clients, not senselessly against them.

March 2018 Postscript: This Old-School Approved Provider took almost 12 months to transfer the client’s Unspent Funds of $5,372.56 to Daughterly Care Community Services. They only transferred the client’s Unspent Funds because we chased them and proved that they had kept the client’s funds for themselves. It was their final opportunity to provide poor administration and poor service.

4) Two ways to not pay an Exit Fee.

If an Exit Fee was a small-fair-fee like $300, well you might feel “fair enough”. However, you never ever need to pay the large unfair Exit Fees being reported in the press and stated on the Government website.

Never ever.

Here’s 2 ways to avoid Exit Fees:

- When your Current Old-School Approved Provider comes knocking and asks you to sign a new Home Care Agreement with their new Exit Fee included – just say “no thank you”.

Say something like this:

“I have been your client for X years and I don’t think it is ethical for you to charge me if I want to leave you. I will only be leaving for better service and value than you have provided me. Don’t you think your time would be better spent focused on providing great service for good value – not wasting time and money signing up vulnerable older people like me? Now, do you want me as your client or not?”

Smile and say nothing more. Just stand your ground.

Don’t cave in to their explanations – the worst one being, “that’s just our fee”. Just reply… “are you wanting me to leave?”

In reality, they want you badly.

Old-School Approved Providers need to retain their existing clients and attract new clients, both of which they have never had to do before. The Government gave them the Home Care Packages and Elders were directed to them and could not move, and when an Elder died they kept the package and gave it to an Elder on their waiting list. Now the Government has taken EVERY SINGLE package off the Approved Providers and ASSIGNED them to the Elders, to move to which ever Approved Provider best suits them.

Now is the time to use your new power.

You have the Home Care Package and now Approved Providers have to FIND YOU and KEEP YOU so don’t be afraid to say “no thank you” to large Exit Fees.

2. The second way to avoid an Exit Fee is to not re-sign your new Home Care Package instead move to a New Breed of Approved Provider like Daughterly Care Community Services. We haven’t charged an Exit Fee for 21 years and we are not going to start now.

5) Large Exit Fees are an unfair last minute money-grab… but the ongoing secret undisclosed fees added to care services every service, every year will cost you far more.

Last week I visited an Approved Provider who had ADDED 15% to the Daughterly Care care fees without disclosing that in the client’s budget, as required by the Home Care Package Guidelines. Two thirds of that was 10% GST incorrectly charged for 2.5 years which they have refunded into the client’s Home Care Package.

The GST amounted to over $5,000 they had incorrectly taken from the client’s Home Care Package and kept for themselves.

The remaining one third was a 5% processing fee added into Daughterly Care’s fee. More commonly the secret undisclosed processing fee is 10% pa.

This week I found undisclosed secret fees of $10 per hour added to the Approved Provider’s true cost of bought care.

People are rightly upset by the Exit Fee but that’s a once off fee. Financially, you should be far more concerned about $45,263.67 worth of errors like these we have found for just 3 clients:

| Date | Old-School Approved Provider Refunded Amount to DCCS client | Error type made by Old-School Approved Provider |

|---|---|---|

| 16 March 2017 | $13,694.08 | Fees charged for a service type not provided. |

| 4 May 2017 | $4,620.28 | Secret Undisclosed fees refunded. |

| 4 May 2017 | $4,359.55 | Level 3 unspent balance illegally kept by Old-School Approved Provider when client upgraded to Level 4 package. Home Care Package Guidelines state, it must be transferred to new level. |

| 4 May 2017 | $4,589.76 | Undisclosed fees refunded. |

| 5 May 2017 | $13,000+ (awaiting team leader’s final approval) | Cognition supplement not organised. |

| 5 May 2017 | $5,000+ (awaiting team leader’s final approval) | GST charged when Government Funded Home Care is GST free. |

| Total refunds to date | $45,263.67 |

1. secret undisclosed embedded fees; and

2. 10% GST incorrectly deducted from your Home Care Package. Read my blog about incorrectly charged GST.

Read my blog about secret undisclosed fees and vote on whether they are ethical so we can put an end to this new and disturbing trend costing Elders thousands every year.

Kate Lambert

B.Ec F.Fin CEO & Co-Founder

Sources: [1] According to choice.com.au.

I support the no exit fee plan

Thank you, Pamela. Every week I find a new old-school Approved Provider who is charging secret undisclosed secret fees. Elderly people are getting ripped off and it has to end. I am in the middle of writing another blog showing misleading and falsely represented fees.

I was charged a 10% handling fee for payment of invoices with my previous provider [ RDNS] and this charge was not disclosed in my agreement with them !!

I agree campaigns led by yourself have resulted in the successful capping of large exit fees that now many providers no longer charge in the thousands and the average exit fee is now approx $400. To clarify though, unspent funds are a LIABILITY for providers, especially now they need to be transferred back to the Commonwealth, to another provider or have the income-tested fee paid by the client refunded to their estate.