If you are a pensioner whose Home Care Package pays for your in home care and you don’t pay additional private care fees to us, then you don’t need to read this article.

If you are a client who:

- pays for care privately; or

- you have a Home Care Package with us and you pay an Income Tested Care Fee

then this article IS FOR YOU and it will be financially advantageous to pass this on to your Accountant / Tax Agent.

This article brings your attention to the Medical Offset Tax Rebate that you can claim on your tax return. Your 2018/2019 tax return is the LAST year you can claim this rebate as the Government has abolished the Medical Offset Rebate from 1/7/2019.

Ask your Accountant what this benefit could be worth to you.

The Tax offset available is:

- 10% of your In Home Care costs (possibly including the Income Tested Care Fee) above $5,609, when your income is greater than $90k pa (single rate).

- 20% of your In Home Care costs (possibly including Income Tested Care Fee) above $2,377), when your income is less than $90k pa (single rate).

Importantly, there is no upper limit on the amount you can claim so our Live in Care and Long Hour clients will benefit the most from this Medical Expenses Rebate Offset.

Please refer to the following two ATO website pages for more information:

https://www.ato.gov.au/individuals/mytax/2019/in-detail/medical-expenses/

(A PDF of the above ATO pages as at 26/7/2019 in case the ATO removes the pages)

It says:

![]()

It says:

Daughterly Care Community Services Ltd is an Approved Care Provider.

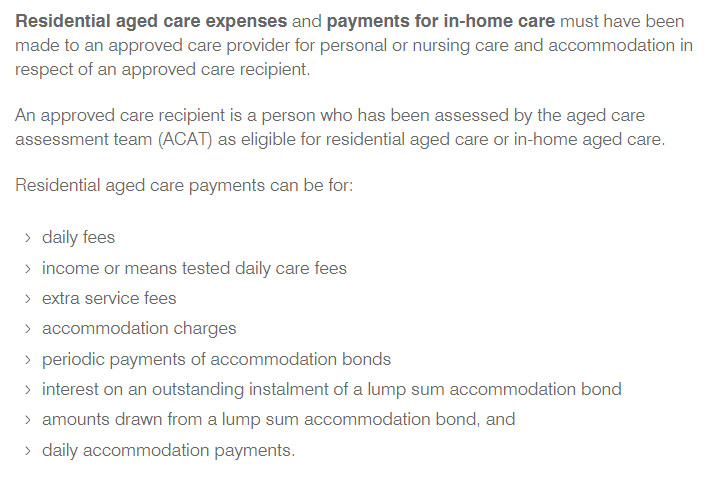

It says:

This means that to be eligible to claim the Medical Offset Tax Rebate you must have an ACAT Assessment and have been approved for (but you don’t have to have been assigned) Residential Care or a Level 1,2,3 or 4 Home Care Package.

Regarding this section:

If the “income or means tested daily care fees” for residential aged care are counted as Medical Expenses for Residential Care then perhaps the Income Tested Care Fee for in home care is also counted in the Medical Expenses. The ATO website is silent on this point.

Action:

- If you have not claimed this rebate in the past, ask your Accountant if it is worth amending your tax return as he/she should have made you aware of this tax rebate. Perhaps then he/she will amend your tax return for free.

- If you would like a print out by financial year of your aged care expenses paid to Daughterly Care for your tax return please email Accounts@daughterlycare.com.au and Andreas will email you a statement for each financial year within a week of the date of receipt of your email. Most of our clients are aware of this tax rebate because they or their accountant requests the summary each year.

I hope this has been helpful for you.

Leave A Comment